ST. GEORGE — Most of Southern Utah continues to steam ahead with high job growth and low unemployment, but even as growth continues, wages fall below the state average.

Job growth

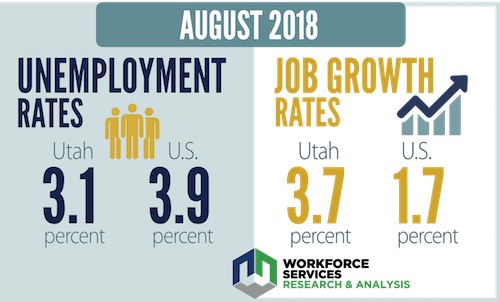

As a whole, Utah’s job growth once again tops the nation, according to latest year-over-year data released by the Utah Department of Workforce Services. Overall nonfarm job growth was 3.7 percent in August, well above the U.S. average of 1.7 percent.

“Utah’s labor market continues to perform at an optimal level with the addition of almost 55,000 jobs over the last year,” said Carrie Mayne, chief economist at the Department of Workforce Services. “The state’s labor force continues to grow and is quickly absorbed into the employment rolls by Utah’s expanding businesses.”

See Mayne outline which industries are growing fastest in the video top of this report.

In southwest Utah, Washington County almost doubles the state average’s job growth at 7.1 percent, with about 4,500 jobs added to the economy since August 2017. Iron County also continues to add jobs at a high pace, standing at 5 percent growth with nearly 1,000 jobs added in the last year.

In the rest of the state’s southwest region, Kane and Beaver counties also saw growth in the same period, with only Garfield County showing virtually neutral growth.

Unemployment in Utah stands at 3.1 percent as of August, the 13th lowest in the country. The unemployment rates in Washington and Iron counties stand at 3.6 and 3.8 percent, respectively.

Wages

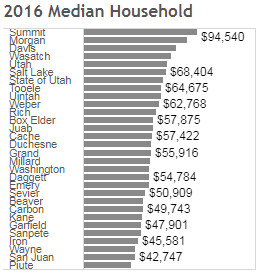

According to the latest data available from the Department of Workforce Services in 2016, Utah’s average household income was $65,931. The county with the highest average household income was in Summit County at $94,540, where high-end resort towns abound.

Of Utah’s 10 counties with the lowest average household income, eight fall within the state’s southernmost region, including Iron County – the 4th lowest – at $45,581. Washington County was a bit higher at $54,784 but still more than $11,000 under the state average.

While Iron County has lower wages on average, people living in the Cedar City area also have a lower cost of living, paying about 14 percent less than the national average for monthly living expenses, according to 2016 data from the Department of Workforce Services.

The same can’t be said for people living in St. George, where the cost of living is only 2 percent lower than the national average. This is compounded by the increasing cost of new residential real estate, which rose 8.6 percent from 2016-2018 in Washington County, according to the University of Utah Ivory-Boyer Real Estate Center’s “Second Quarter 2018 Construction Report.”

According to a report by Senior Economist Lecia Langston of the Department of Workforce Services’ St. George office, the average Washington County wage in 2016 measured just 76 percent of the state average.

“The contrast between Salt Lake County and Washington County wages is even more dire,” Langston wrote. “Washington’s average wage measures 67 percent of that of Salt Lake County.

“The average monthly new hire wage in Salt Lake County for 2016 measured $2,600 compared to less than $1,900 in Washington County. It is unlikely that most workers come out ahead monetarily by making a job move to Washington County.”

In a previous St. George News story, Langston said low average wages is a specific reason companies are attracted to doing business in Washington County.

On the state and local level, some government leaders in Southern Utah are working to change this by offering tax incentives to companies that can demonstrate that they offer average wages and benefit packages that are higher than county averages.

These tax breaks in turn create more competition for other employers to also step up their salary and benefit offerings, state Rep. V. Lowry Snow, R-District 74 of Southern Utah, said in a previous interview with St. George News.

In April, the St. George City Council approved a 10-year tax agreement with St. George-based Ram Manufacturing Company to incentivize creation of new jobs.

Read more: City approves tax incentive with Ram Company as the aerospace manufacturer prepares to add 38 jobs

Ram Company currently employs hundreds of people with average annual wages and benefit packages that are more than 50 percent higher than the Washington County average, and the tax incentive will remain in place as long as the company maintains the competitive employment packages.

Email: [email protected]

Twitter: @STGnews

Copyright St. George News, SaintGeorgeUtah.com LLC, 2018, all rights reserved.

Of course, the republican line, more jobs, more jobs. In reality not enough to live on

Well, right to work state and jobs jobs jobs and non-union places to work while allowing undocumented workers = wage suppression and stagnation.

Wow lower wages being paid in Southern Utah ? well golly gee whiz I’m shocked ! absolutely stunned ! duh !

A story about jobs, you should take it more serious.

To me, this is the most beautiful place on earth. But the wages are so low, people have to work multiple (minimum wage) jobs to make ends meet. I sent my children out of state for college and am thankful they chose to live elsewhere so they will be able to make a living.

Yeah, we made more money in California. But we lived in a $600,000, 1100 square foot condo with a HUGE mortgage, $4,500+ in property taxes PLUS association fees. So many people and nowhere to build so housing was at a premium and apartment rentals were $2,000-$2500+ a month. (try to save for a house paying that) Paid over $4.00 a gallon for gas. Auto insurance was twice as much as here. If I needed to drive two miles, I had to give myself at least 30 minutes to get there due to the traffic. Literally nowhere to go to “get away” because it was just one big city with no open spaces. If you wanted to have fun, you paid for it. Couldn’t understand most customer service employees due to the language barrier, and trying to get a correct order at a drive thru fast food restaurant was a complete joke because nobody speaks English. Trying to breath during the summer “smog season” was always fun. Almost EVERYTHING was WAY more expensive there, the cost of living was terrible. We live better here on Social Security and a small pension than we ever did in California making $140,000 a year. So, sure, go somewhere else and make more money !! It’s all relative. The more you make, the more you have to spend.

It’s impossible to make ends meet here. Me and my husband and our son have had to move back in to his parents basement 3 times in 2 years. We both work and still have to struggle to get gas money and money for groceries and our son is always getting told no to everything he asks for. It’s heartbreaking to never be able to say yes once in a while. I haven’t been home to see my family in 5 years, my son doesn’t even know his mother’s side of his family. We never can afford to do anything so we work we come home we go to bed we get up and do the same thing everyday with no break that involves any fun for our son or ourselves. It’s depressing we are down to one car bc we couldn’t afford to keep the 2nd. We are in our late 30’s and miserable. We try to apply for help but told we make too much but yet can’t afford to do things like the doctor for example for myself bc we can’t afford to add me to my husband’s insurance just our son and him bc it’s required. So we have thought of moving but can’t afford to do that either so what is it we are to do when the wages are so low and the cost of living is so high?